Palm Beach County Real Estate Market Update | September 2025

Palm Beach County Real Estate Market Update | September 2025

The Palm Beach County housing market continues to move steadily — and there’s opportunity on both sides if you play it smart.

With interest rates hitting the lowest levels we’ve seen all year and inventory hovering in balanced territory, the end of 2025 could shape up to be strong for both buyers and sellers.

Single-Family Homes: A Balanced Market Holding Strong

Single-Family Homes: A Balanced Market Holding Strong

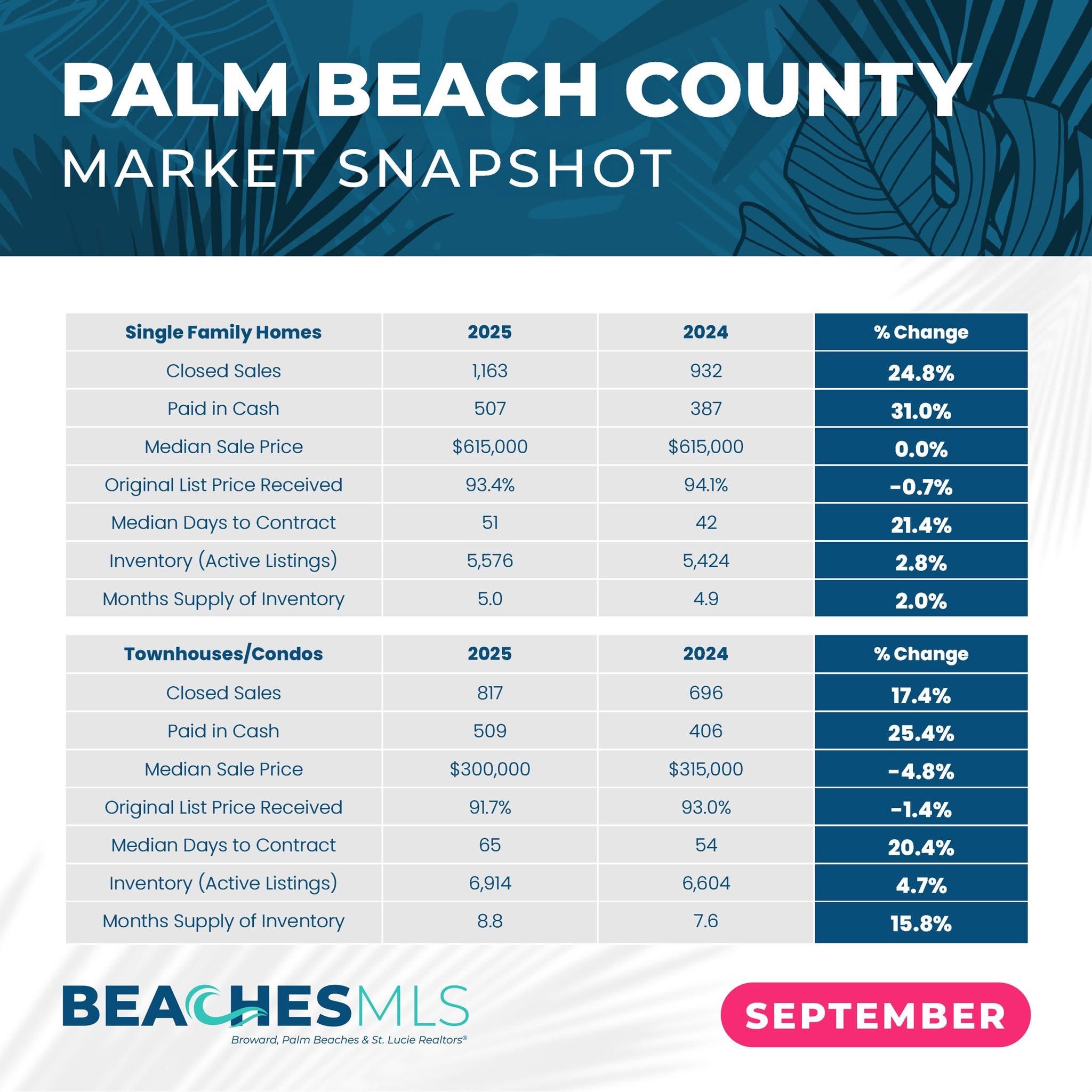

Inventory for single-family homes sits at around 5 to 5½ months, keeping Palm Beach County in a balanced market.

Median sale prices have held steady compared to 2024, and the number of closed sales is tracking right alongside — in fact, we’re even seeing a slight increase year-over-year.

In short: The market’s not cooling off — it’s holding its ground.

Condos & Townhomes: Gradual Improvement, But Still Soft

Condos & Townhomes: Gradual Improvement, But Still Soft

The condo and townhome market still shows more inventory — roughly 8 to 9 months’ supply — but that’s down from the spring peak of over 10 months.

Sellers are starting to adjust pricing or take listings off the market, helping reduce that oversupply.

Median prices for condos and townhomes combined are around $285,000, down from $315,000 this time last year.

Move-in-ready units and properties with updated features are still drawing solid offers, while those needing work are taking longer to sell.

Interest Rates: The Game-Changer

Interest Rates: The Game-Changer

Here’s the headline: Mortgage rates have dropped into the low-6% range — the lowest we’ve seen in 2025.

That’s giving many buyers the green light they’ve been waiting for.

When rates fall, buyer activity rises — and that means more competition for well-priced homes heading into the final stretch of the year.

What to Expect Through the End of 2025

What to Expect Through the End of 2025

As we close out the year, expect the market to heat up through the fall and early winter.

Many buyers are aiming to purchase before January to establish Florida homestead exemptions for 2026, while investors are looking to add properties before year-end for tax planning.

If interest rates continue to ease, we could see another wave of demand by late November — especially for move-in-ready single-family homes in desirable areas.

Condos may still take longer to move unless they’re competitively priced or recently renovated.

What This Means for You

What This Means for You

Buyers:

If you’ve been sitting on the sidelines, this could be your moment. Lower rates mean better affordability — but also more competition.

Sellers:

Homes that show well and are priced right are selling close to asking. The key is presentation and strategy.

Investors:

With rates softening and motivated sellers in the condo market, opportunities are out there — especially before year-end.

Ready to Make Your Move?

Whether you’re looking to buy, sell, or invest before the year wraps up, now’s the time to position yourself for success.

Let’s talk strategy and make your next move in Palm Beach County a smart one.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Palm Beach County Real Estate Market Update | September 2025

Palm Beach County Real Estate Market Update | September 2025 Single-Family Homes: A Balanced Market Holding Strong

Single-Family Homes: A Balanced Market Holding Strong Condos & Townhomes: Gradual Improvement, But Still Soft

Condos & Townhomes: Gradual Improvement, But Still Soft Interest Rates: The Game-Changer

Interest Rates: The Game-Changer What to Expect Through the End of 2025

What to Expect Through the End of 2025 What This Means for You

What This Means for You